Maximize your savings by discovering smart investment options

Combat market uncertainty and ride out the current rate volatility.

Eligible deposits in registered accounts have unlimited deposit insurance coverage through the Financial Services Regulatory Authority (FSRA).

Get a great rate today!

Guaranteed Investment Certificate (GIC)

A low-risk investment that functions similarly to a savings account, deposit money into a GIC account, and earn the guaranteed posted interest over time. The difference is, a GIC requires you to leave the money in the account for a specified period of time – a term. Upon completion of the term period, you receive the entire sum that you deposited, plus your earned interest.

Tax-Free Savings Account (TFSA)

Registered Retirement Income Fund (RRIF)

A RRIF is a financial product funded with RRSP deposits and designed to provide an income stream during retirement. Interest accumulates tax free in a RRIF deposit until the funds are paid out. A RRIF may be purchased any time prior to December 31st of the year the plan holder reaches age 71.

First Home Savings Account (FHSA)

Registered Retirement Savings Plan (RRSP)

Know that your deposits are protected

Eligible deposits in registered accounts have unlimited coverage through the Financial Services Regulatory Authority (FSRA). Eligible deposits (not in registered accounts) are insured up to $250,000 through the Financial Services Regulatory Authority (FSRA).

Investment Shares

A Better Way to Invest

How do Investment Shares work?

Investment Shares are a straightforward investment option. Each Investment Share costs $1. There are no commissions or fees associated with purchasing Investment Shares. The minimum purchase is 500 Investment Shares ($500). This can be funded from your WFCU account, including your Tax-Free Savings Account (TFSA), Registered Retirement Savings Plan (RRSP), or Registered Retirement Income Fund (RRIF).

What Are the Benefits?

Premium returns

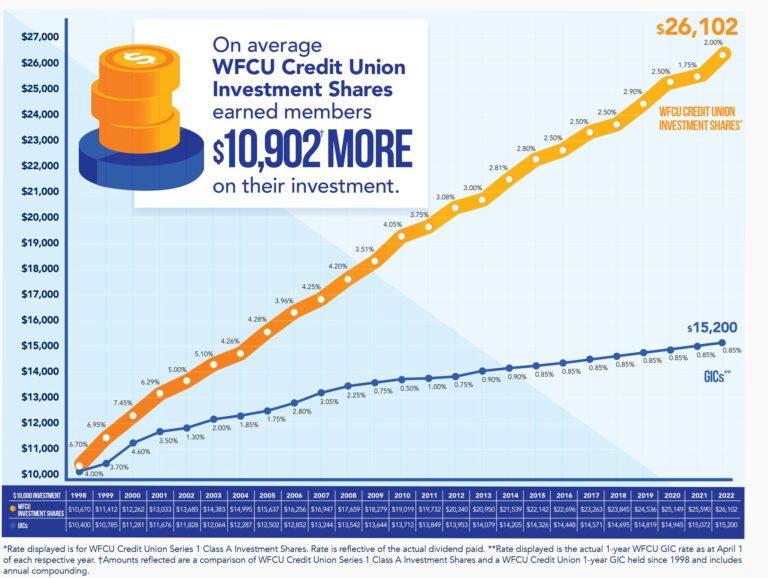

Our Investment Shares earn a premium rate of return. On average WFCU Investment Shares earned members $10,902 more on their investment***

Diversification

If you’re looking to diversify your portfolio while minimizing risks, our Investment Share series is the perfect addition to your holdings.

Stronger together

Investing directly with us helps strengthen WFCU, benefitting all members through innovative banking products and services.

Community investment

WFCU is committed to making the communities we serve the best places to live and work. Investment Shares help support this.

***Amounts reflected are a comparison of WFCU Credit Union Series 1 Class A Investment Shares and a WFCU Credit Union 1-year GIC held since 1998 and includes annual compounding.

What’s on your bucket list?

Ensure your future goals are within reach.

Financial confidence is a conversation away!

Whether you’re saving for your first home, planning for retirement, or protecting your estate, our team is here to help you achieve your financial goals – even in a challenging marketplace.

With over 80 years of experience helping Ontarians realize their life goals, WFCU’s wealth management division, Avanti Investment Services, in partnership with Credential Asset Management Inc.****, is highly qualified to assist you with financial guidance and wealth management needs.

****Mutual funds are offered through Credential Asset Management Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise stated, mutual fund securities and cash balances are not insured or guaranteed and are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer that insures deposits in credit unions. Their values change frequently and past performance may not be repeated.

About us

WFCU Credit Union is a leading financial institution headquartered in Windsor since 1940. It is the sixth-largest credit union in Ontario and the twentieth-largest in Canada.

WFCU Credit Union operates nine retail locations in Windsor-Essex, one in Chatham, one in London, and three in the Waterloo Region through ECU – A Division of WFCU Credit Union.

Through our various service channels, including online and mobile banking, and ATM services, WFCU and its numerous divisions, including ECU, have become the financial institutions of choice for over 70,000 members across Ontario. WFCU membership is open to anyone living and/or working in Ontario.

Invest in your community

A portion of our members’ deposits is reinvested into our communities, making them more vibrant places to work and play. Through our INSPIRE program, we provide engaging, entertaining, and educational opportunities for people to come together as a community.

Learn more here.